nj ev tax credit tesla

As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. 30 of the cost OR maximum 1000.

Connecticut Weighs Options For Making Electric Vehicle Rebates More Equitable Energy News Network

Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives.

. Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as 12500 off the sticker price of. You would need to spend over 333333 to claim the full 1000 credit. So based on the date of your purchase TurboTax is correct stating that the credit is not.

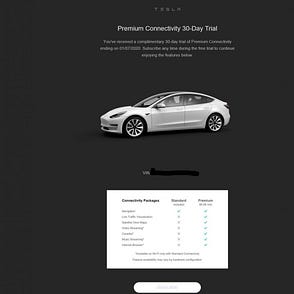

On January 17 2020 Governor Murphy signed S-2252 into law PL2019 c362 which created an incentive program for light-duty electric vehicles and at-home electric charging infrastructure. The legislation creates a state rebate giving consumers a credit of 25 per mile of electric range for their car up to a max of 5000. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

Your Charge up New Jersey Incentive application meets our eligibility criteria for your Tesla Model 3 for 500000. 1000 is the maximum per installation. If you only spent 600 you can claim 30 of 600 IE 180.

5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission vehicles ZEVs which are vehicles certified pursuant to the California Air Resources Board zero emission standards for the model year. Several months later it seems that revisions to the credit are returning to lawmaker agendas. Tesla 2021 Model Y long range AWD 326.

Up to 1000 State Tax Credit. For 2020 no Federal EV purchase tax credit was scheduled. According to the Department of Environmental Protection the New Jersey ZEV exemption program entitles drivers to a.

The renewal of an EV tax credit for Tesla provides new opportunities for growth 2. So a car with a 200-mile battery range would qualify for the full amount. New Jerseys Energy Master Plan outlines key strategies to reduce energy consumption and emissions from the transportation sector including encouraging electric vehicle adoption electrifying transportation systems leveraging technology to reduce emissions and miles traveled and prioritizing clean transportation options in underserved communities to reach the.

Select utilities may offer a storage incentive. Car buyers whose Teslas were delivered in the last half of 2019 will receive only about 25 of the full tax credit which is 1875. 2500 rebate for new vehicles with a purchase price under 50000.

You may notice something surprisingtheres no way to get an EV tax credit in 2022 for a Tesla or GM EV. Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA. A bill that just passed the state Legislature would give New Jersey among the strongest electric-car incentives in the country.

Answered on Mar 17 2022. Select utilities may offer a solar incentive filed on behalf of the customer Powerwall. Beginning on January 1 2021.

0 0 You Save 5300 79990 Tesla 2021 Model S Plaid. At first glance this credit may sound like a simple flat rate but that is unfortunately not the case. If you dedicate the 14-50 charging cable to your home you should be able to claim the tax credit of the lesser of.

EV purchases would earn a 5000 rebate for models with 200 miles of. The reason is that once a car manufacturer sells its 200000th vehicle the credit is reduced being cut in half to 3750 is then halved again after a period and then finally phased out. Zero Emissions Vehicle ZEV drivers are exempt from the NJ sales tax.

In President Bidens State of the Union address the President voiced support for revisiting EV tax credits in 2022. Charge Up New Jersey provides a rebate of up to 5000 toward a new EV purchased or leased in New Jersey. The exemption is NOT applicable to partial.

We have reached the funding cap for this fiscal year. Electric Vehicles Solar and Energy Storage. Local and Utility Incentives.

However this does not apply to Plug-in Electric Vehicles PEVs. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. Funding is allocated on a fiscal year basis and incentives are available only while funding lasts.

March 14 2022 528 AM. Hybrid cars can also qualify for rebates but their range of electric power is usually limited because they also use gas as a power source. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019.

Owners must be registered in New Jersey and will get 25 for each mile the car uses to run on electric power up to 5000. 0 You Save 7425 112090. Tesla 2021 Model S long range 412.

Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured. Yes the state of New Jersey has a tax credit for electric car drivers. Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000 credit.

This credit includes both the 7500 main credit plus another 500 for Tesla cars with American-made batteries House version or another 2500 Senate version. 1 Best answer. 5000 0 You Save 3200.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. There are however remaining state-issued tax credits for which many new Tesla EV. TRENTON - The New Jersey Board of Public Utilities NJBPU opened Year 2 of its Charge Up New Jersey electric vehicle EV incentive program today taking one more step toward the Murphy Administrations goal of getting 330000 EVs on the road by 2025.

Eligible Vehicles Charge Up New Jersey

Latest On Tesla Ev Tax Credit March 2022

New Jersey Offering 5 000 Off Evs Getjerry Com

Biden S Electric Vehicle Ambitions May Send Tesla Stock Skyrocketing Beyond 1 300 Analyst

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

The Benefits Of Buying And Registering A Tesla In New Jersey By Onlyusedtesla Medium

N J Wants To Pay You To Buy An Electric Vehicle But It Hasn T Said When It Will Resume Doing So Nj Com

The Benefits Of Buying And Registering A Tesla In New Jersey By Onlyusedtesla Medium

N J Wants To Pay You To Buy An Electric Vehicle But It Hasn T Said When It Will Resume Doing So Nj Com

Tesla Climbs As Other Ev Makers Hit Brakes After Rally

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Which Vehicles Qualify For An Ev Tax Credit In 2022 Getjerry Com

Pros And Cons Of Buying An Electric Vehicle In 2020 Vs 2021 Aspentimes Com

Trend With Electric Car Incentives Lapsing New Jersey Adds In Up To 5 000 For Ev Buyers

New Jersey Eyes All Electric Vehicle Shift By 2035

Eligible Vehicles Charge Up New Jersey

Car Rental Company Launches Tesla Fleet In Ca Ny Nj With Model 3 For 995 Per Month

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa